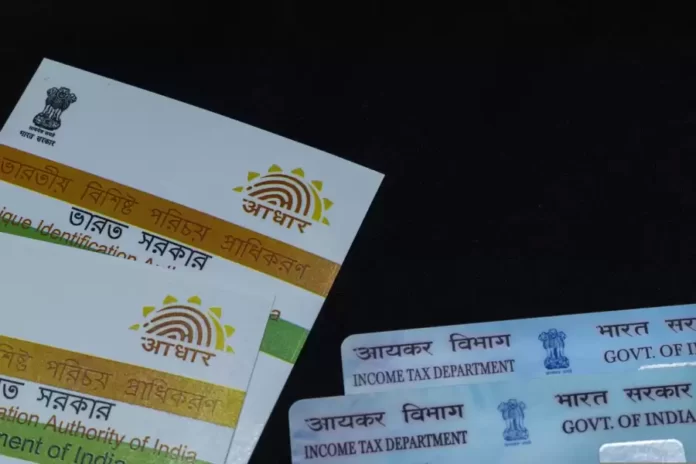

According to the CBDT or Central Board of Direct Taxes, all taxpayers need to compulsorily link their Adhaar number with a PAN Card number as soon as possible. Earlier, the last date to link was 31st March 2023. However, the Govt has increased the date to June now. As per the 139AA of the Income Tax Act 1961, it’s compulsory for every eligible person to obtain their Aadhaar card and link pan number with aadhaar.

If you want to know more details about the whole Adhaar-Pan Card scenario, then you are at the right place. Here we will share all the details available about the Adhaar and Pan Card number link. Moreover, we will also tell you what would happen if you don’t link your Adhaar number with your PAN Card.

Why Do We Need To Link Adhaar Card Number With PAN?

As per the new rules of the government, it’s compulsory to link PAN cards with Adhaar cards to reduce the incidence of duplicate PAN cards that’s been going on around. The duplicate PAN cards pave the way for inaccurate calculation as well as the collection of taxes. So, in order to solve this issue, the Govt has made it compulsory for all taxpayers to link their Adhaar with their PAN card.

Furthermore, it’s also true that a person having multiple PAN cards can make it difficult for the authorities to track down tax evasion. Therefore, to avoid such problems, the Govt has taken the necessary steps to reduce tax evasion in the country.

What Happens If You Don’t Link Your PAN With Adhaar?

There are a lot of people who want to know the consequences of not linking Aadhaar with a PAN number. According to the facts, if you fail to link Aadhaar number with PAN card within the deadline, then the 10-digit unique alphanumeric number of your PAN card will become inoperative. There will be other penalties along with this one.

For example, the TCS/TDS reduction will get a higher rate applicable to PAN. Your PAN won’t work until it’s linked with Adhaar. Furthermore, you won’t be able to book a fixed deposit above 50k Rs. in any bank. In addition, you also won’t be able to deposit cash above 50k. Obtaining new Credit or Debit card won’t be possible.

In addition, you also won’t be able to invest or redeem your mutual funds in that case. Last but not least, without the Adhaar PAN link, it’s not possible to purchase any foreign currency beyond 50k Rs. The Taxpayers who haven’t linked their Aadhaar number with their PAN can do so by paying Rs. 1000 as a late fee. The deadline has been pushed to June 2023, as we mentioned earlier.

How To Link PAN-Aadhaar Numbers?

So, in case you haven’t linked with Aadhaar number with your PAN card yet, you can do so without any trouble. All you have to do is to follow the steps that we will be showing below.

- First, you need to open the Income Tax e-Filling Portal.

- After that, click on the Link Aadhaar option on the site.

- Next, you need to fill in your PAN card and Aadhaar card number as well as the name (As per Aadhaar) in the required fields.

- So, once you do that, click on Validate to verify the details and then you can submit the form.

Once the linking is successful, you will see a confirmation message appear on the screen. Next, you will receive an OTP number on your registered mobile phone number. But, if you are an NRI, not a citizen of India, or above 80 years old, then you are exempted from this Aadhaar-PAN linking. In addition, if your state of residence is Meghalaya, Assam, and Jammu & Kashmir, then you are also exempted from this linking.

Also read: How To Install AngularJS