Personal finance has evolved over the last decade, capitalising on smartphone usage and banking apps to make banking more interactive and accessible. The range of products available has grown, expanding beyond traditional banking and opening the door for new players.

People can now manage their finances in real-time at the push of a button and save in ways which suit their lifestyle. With how intrinsically linked modern life is with technology, here’s how personal finance has been affected by advancements in financial tech (fintech).

How money apps changed personal finance

What started with online banking tools has been refined by mobile banking apps. People were no longer tethered to using branches or ATMs for their banking activities, and by making use of mobile technology, you can review your account at a moment’s notice on your phone.

Money apps gave people greater flexibility and visibility with their personal finance, setting up alerts for when money was moving in or out and applying for financial products on the fly. Other areas of personal finance, such as investing apps and savings apps, also gradually emerged onto emerged on the market.

Some experts expect that almost three-quarters of adults in the UK will be using mobile banking in the next few years, with the door for digital-only banks to enter the world of finance firmly thrown open. Sometimes called ‘challenger banks’, these do away with the idea of branches completely, allowing people to do all their banking online seamlessly.

Keeping an eye on our wallets

In a survey from Monese, the mobile money app, one in five people said that they wanted to get better at tracking what they were spending as one of their main savings goals.

Mobile banking apps like Monese provide just that, giving you a real-time look at your finances and an easy breakdown of where your money has gone. That way, you can see where you might want to cut back on spending.

This also links back to the top savings goals raised within the survey, with rainy day funds (37%), hitting savings milestones (26%), and saving for holidays/travel (25%) being the main goals set. Better savings start with understanding where all your money goes.

Saving for a new generation

For millennials, who’ve grown up with mobile phones for a significant portion of their lives, mobile banking feels like a logical step. We use our phones for practically everything else in our lives, so why not our personal finance?

The amount of screen time we clock up annually is increasing as technology plays an ever-increasing role within our lives, averaging 4,866 hours a year for UK adults. Incorporating our personal finance activities into this using the latest fintech seems natural if we’re already spending so much of our time using devices.

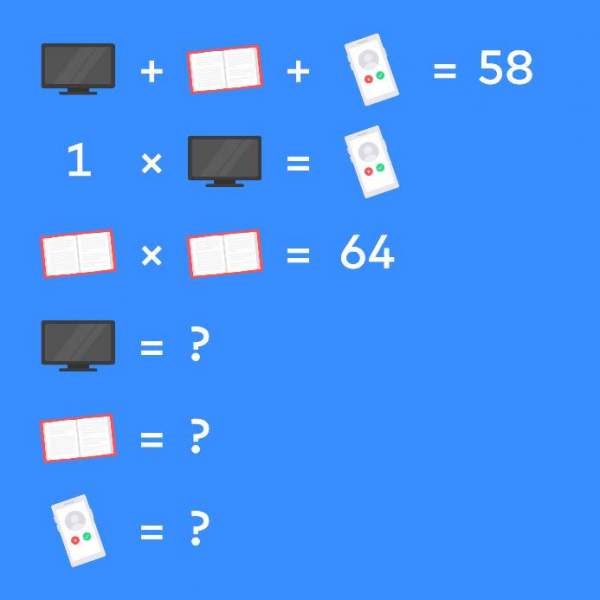

Monese have created a quick brainteaser for those who’re looking to get better at tracking and understanding their spending – why not have a go and see how your financial skills stack up?

Hints:

- TV = 25

Answers:

- TV = 25 / Book = 8 / Phone = 25

Read Also : How To Streamline Your Company’s Payroll ?