Buying a vehicle is rarely an impulse decision.

It’s emotional, yes—but it’s also deeply financial.

And at the heart of that financial decision sits one quiet but powerful number: the vehicle loan interest rate.

Most borrowers glance at it.

Smart borrowers understand it.

This guide breaks it down—not in banker language, but in real terms you can actually use before signing a car loan agreement.

What Is a Vehicle Loan Interest Rate (In Simple Words)?

A vehicle loan interest rate is the cost you pay for borrowing money to buy a car, bike, or commercial vehicle.

Think of it like rent.

You’re renting money from a lender—and the interest rate is the rent you pay every month.

Even a small difference (say 0.5%) can quietly change your total repayment by thousands over the loan tenure.

Why Vehicle Loan Interest Rate Matters More Than EMI

Many borrowers focus only on EMI.

That’s a mistake.

Here’s why:

EMI shows monthly comfort

Interest rate decides total cost

A slightly lower EMI with a higher interest rate often costs more over time.

Real-life example:

Two friends buy similar cars.

One chooses a loan with a slightly higher rate but longer tenure.

Five years later, he has paid ₹60,000 more—without realizing why.

Key Factors That Decide Your Vehicle Loan Interest Rate

Lenders don’t pick interest rates randomly.

They price risk.

1. Credit Score (The Silent Judge)

Your credit score tells lenders how you’ve handled money in the past.

750+ → Lower risk → Better rates

Below 650 → Higher risk → Higher rates

Even a 20-point improvement can unlock better pricing.

2. Type of Vehicle You’re Buying

Yes, the vehicle itself matters.

| Vehicle Type | Typical Risk Level |

|---|---|

| New Car | Lower |

| Used Car | Medium |

| Commercial Vehicle | Higher |

New vehicles usually attract lower vehicle loan interest rates because their resale value is predictable.

3. Loan Tenure

Longer tenure = more risk for the lender.

Short tenure → Lower interest burden

Longer tenure → Higher total interest paid

Sometimes a slightly higher EMI saves you big money overall.

4. Income Stability

Not just how much you earn—but how consistently.

Salaried professionals with stable income often get better rates

Self-employed borrowers may see slightly higher pricing (unless income history is strong)

Fixed vs Floating Vehicle Loan Interest Rate

This choice impacts peace of mind more than most people realize.

Fixed Interest Rate

Rate stays constant

EMI remains predictable

Ideal for budget planners

Floating Interest Rate

Linked to market conditions

EMI can go up or down

Beneficial when rates are expected to fall

Tip:

If predictability matters more than chasing minor savings, fixed rates offer psychological comfort.

How Lenders Actually Price Vehicle Loan Interest Rates

Behind the scenes, lenders consider:

Cost of funds

Market interest trends

Borrower risk profile

Vehicle resale value

Operational costs

This is why two people applying on the same day can receive different interest rates.

Practical Ways to Secure a Better Vehicle Loan Interest Rate

1. Improve Credit Score Before Applying

Clear small dues.

Avoid multiple loan enquiries.

Pay EMIs on time for at least 3–6 months before applying.

2. Choose Shorter Tenure (If Affordable)

A loan for 4 years instead of 6 can dramatically reduce interest paid—even if EMI rises slightly.

3. Make a Higher Down Payment

Lower loan amount = lower risk.

Even an extra 5–10% down payment can improve your rate negotiation power.

4. Compare Offers, Not Just Advertised Rates

The “starting from” rate is rarely what most people get.

Always ask:

Final approved interest rate

Processing fees

Prepayment rules

Vehicle Loan Interest Rate vs Fixed Deposit Returns (Smart Perspective)

This is where financially aware borrowers think differently.

If:

Your FD earns 7%

Your vehicle loan costs 10%

You’re effectively losing 3% annually by not reducing loan burden faster.

Sometimes, partial prepayment makes more sense than holding low-yield investments.

(This isn’t advice—just a perspective smart borrowers consider.)

Why Trustworthy Lenders Matter as Much as the Rate

A low vehicle loan interest rate means little if:

Foreclosure rules are unclear

Customer support is weak

Statements are confusing

Reputed lenders focus on:

Transparent pricing

Clear communication

Responsible lending practices

For broader understanding of vehicle financing norms, you may also refer to RBI’s consumer loan guidelines via the Reserve Bank of India (high-authority source).

👉 https://www.rbi.org.in

(Only one external authority link used, as requested.)

Common Mistakes Borrowers Make (And Regret Later)

Accepting first offer without comparison

Ignoring processing fees

Stretching tenure just to reduce EMI

Not reading foreclosure clauses

Underestimating total interest paid

Most regrets don’t come immediately—they surface years later.

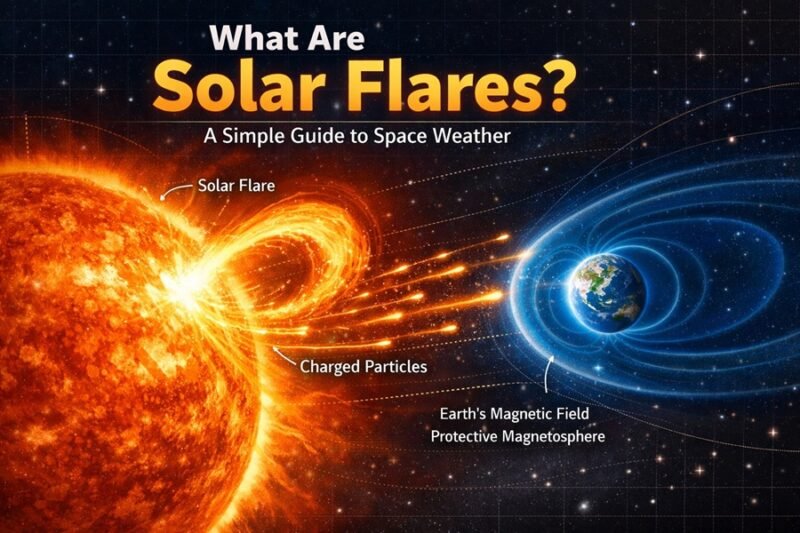

Alt Text

Vehicle loan interest rate explained with real-life borrowing scenario

Caption

Understanding vehicle loan interest rates helps borrowers make smarter, long-term financial decisions.

Final Thoughts: Interest Rate Is a Decision, Not a Number

A vehicle loan interest rate isn’t just a percentage on paper.

It’s:

Time

Commitment

Opportunity cost

Borrowers who understand this don’t just buy vehicles—they finance them wisely.

A calm decision today often saves years of quiet financial stress tomorrow.

FAQs (Unique, Human & Practical)

1. Can I negotiate my vehicle loan interest rate?

Yes. Strong credit score, higher down payment, or existing relationship with the lender can improve negotiation outcomes.

2. Is a lower EMI always better?

Not necessarily. Lower EMI often means longer tenure—and higher total interest paid over time.

3. Do used cars always have higher interest rates?

Usually yes, because resale value and risk are higher. However, borrower profile can still influence final pricing.

4. Will prepayment reduce my interest burden?

Yes. Prepaying principal early reduces the total interest you pay across the loan tenure.

5. Does changing lenders later make sense?

It can—if interest savings outweigh foreclosure and processing costs. Always calculate before switching.